Nous allons effectuer une opération de maintenance le week-end du 8 novembre 2025. En conséquence, le service IP sera désactivé sur l'ensemble du week-end. Les opérations seront effectuées en SEPA classique.

08 - Specific BerlinGroup Implementation

- API base URL: https://api.neuflizeobc.fr

- Authorisation base URL: https://w.api.neuflizeobc.fr/public

- Sandbox base URL : https://sandbox.neuflizeobc.fr

- Sandbox authorisation base URL : https://w.sandbox.neuflizeobc.fr/public

- BerlinGroup Conformity : Implementation Guidelines

version 1.3

More details on how the APIs work, including sample queries, etc, are available in the Berlin Group's specifications. The above link redirects to the Implementation Guidelines, as well as the Berlin Group specifications in Open API 3.0 format.

A valid QWAC Certificate for PSD2 is required to access the Sandbox and Berlin Group API. The following conditions are verified:

- The certificate must be valid (the connection date is strictly between the creation date and the expiration date of the certificate)

- The certificate must be issued by a QWAC Certificate Authority. The official list of QTSP is available on the eIDAS Trusted List

- The certificate should not be revoked

A TPP can provide and use any number of valid certificates as long as the CA properties and organizationIdentifier stay the same. The old certificates are not revoked when a new valid certificate is presented by the TPP and can be kept in use until their expiration date is passed.

| SCA Approach | Supported | |

|---|---|---|

| Redirect OAuth 2.0 workflow | ✔ | |

| App redirection using App-to-App redirection based on deep linking workflow | ✖ | |

| Decoupled workflow | ✖ | |

| Embedded workflow | ✖ | |

| Services | Supported | |

|---|---|---|

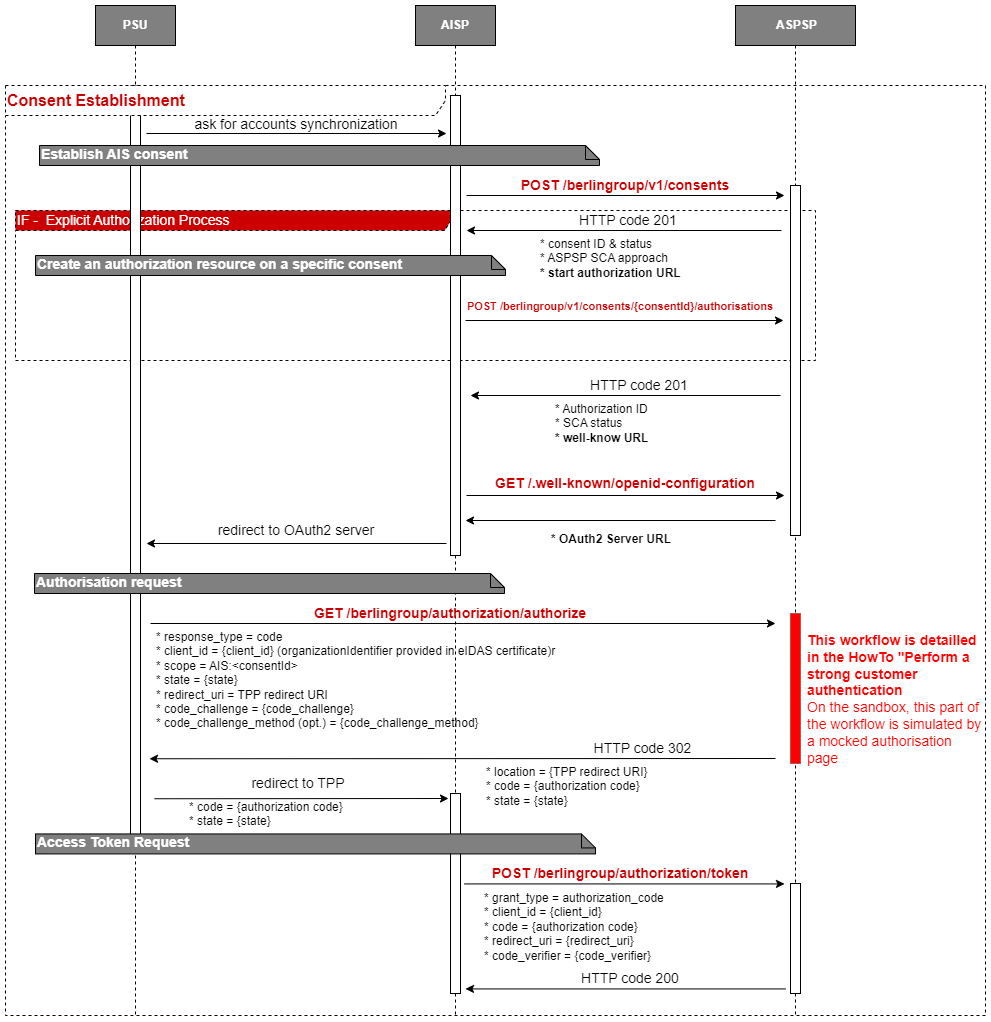

| Support of multiple consents | ✔ | |

| Support of Signing Baskets | ✖ | |

| Support of Card Accounts Endpoints | ✖ | |

| Support display of Account ownerName and ownerNames | ✖ | |

| Support display of Account psuName | ✖ | |

| Owner name always delivered without taking into account the consent scope | ✖ | |

| Support of Trusted Beneficiaries endpoint | ✖ | |

| Support of Multilevel SCA Approach | ✖ | |

| Maximum Frequency Per Day Value Supported on Consent Request | 4 | |

| SCA Validity for a current consent | 180 days | |

| SCA Validity for a one-off consent | 20 min | |

| Consent establishment Timeout | 3 days | |

| Support of parameter withBalance on APIs | ✖ | |

| Supported Account Reference Identifiers | IBAN | ✔ |

| MaskedPan | ✖ | |

| BBAN | ✖ | |

| Consent scope | Dedicated consent (List of accounts) | ✔ |

| Dedicated consent - Support of ownerName in additionalInformation property | ✖ | |

| Dedicated consent - Support of trustedBeneficiaries in additionalInformation property | ✖ | |

| Global consent - availableAccounts = allAccounts | ✔ | |

| Global consent - availableAccountsWithBalance= allAccounts | ✔ | |

| Global consent - allPsd2= allAccounts | ✔ | |

| Global consent - availableAccounts = allAccountsWithOwnerName | ✖ | |

| Global consent - availableAccountsWithBalance= allAccountsWithOwnerName | ✖ | |

| Global consent - allPsd2= allAccountsWithOwnerName | ✖ | |

| Supported Access for MultiCurrency Accounts | ✖ | |

| Multicurrency level | Aggregation level | ✖ |

| Sub-account level | ✖ | |

| Aggregation & sub-account level | ✖ | |

| Balance Type | closingBooked | ✔ |

| expected | ✖ | |

| openingBooked | ✖ | |

| interimAvailable | ✖ | |

| interimBooked | ✖ | |

| forwardAvailable | ✖ | |

| Supported Transactions Query Parameters | bookingStatus = booked | ✔ |

| bookingStatus = pending | ✖ | |

| bookingStatus = both | ✖ | |

| bookingStatus = all to request all types of transactions (pending, booked and information) at once | ✖ | |

| dateFrom | ✔ | |

| dateTo | ✔ | |

| entryReferenceFrom | ✖ | |

| deltaList | ✖ | |

| Support of Standing orders endpoint (bookingStatus=information) | ✖ | |

| Supported optional transaction information (Standing Orders) | debtorName | ✖ |

| instructionIdentification | ✖ | |

| remittanceInformationUnstructuredArray | ✖ | |

| remittanceInformationStructuredArray | ✖ | |

| creditorAgent | ✖ | |

| debtorAgent | ✖ | |

| balanceAfterTransaction | ✖ | |

| Services | Supported | |

|---|---|---|

| Support of Signing Baskets | ✖ | |

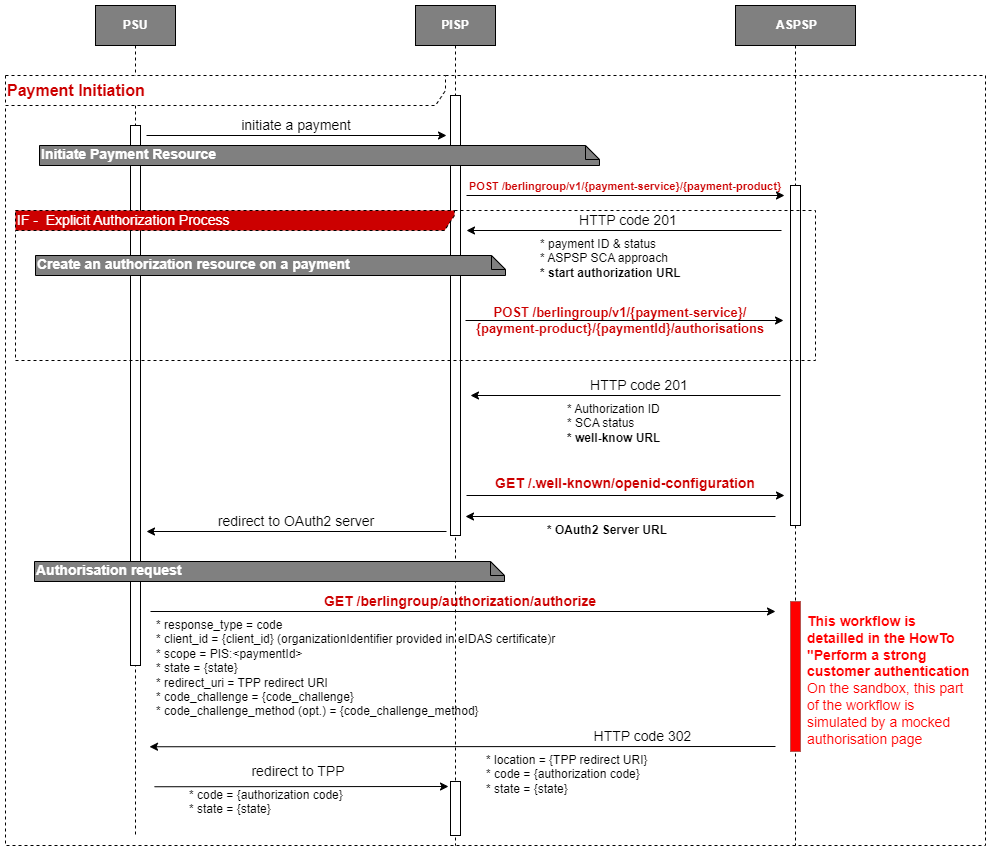

| Payment initiation Timeout | 2 days | |

| Support of PIS without IBAN - Retrieval of debtor accounts with AIS flow | ✔ | |

| Selection of debtor account on CBS pages when payment submission without IBAN | ✖ | |

| Funds Availability on Payment Status Information (implicit FCS over PIS) | ✖ |

|

| Support of TPP-Rejection-NoFunds-Preferred Header | ✖ | |

| Support payment status notification (instant payment only) | ✖ | |

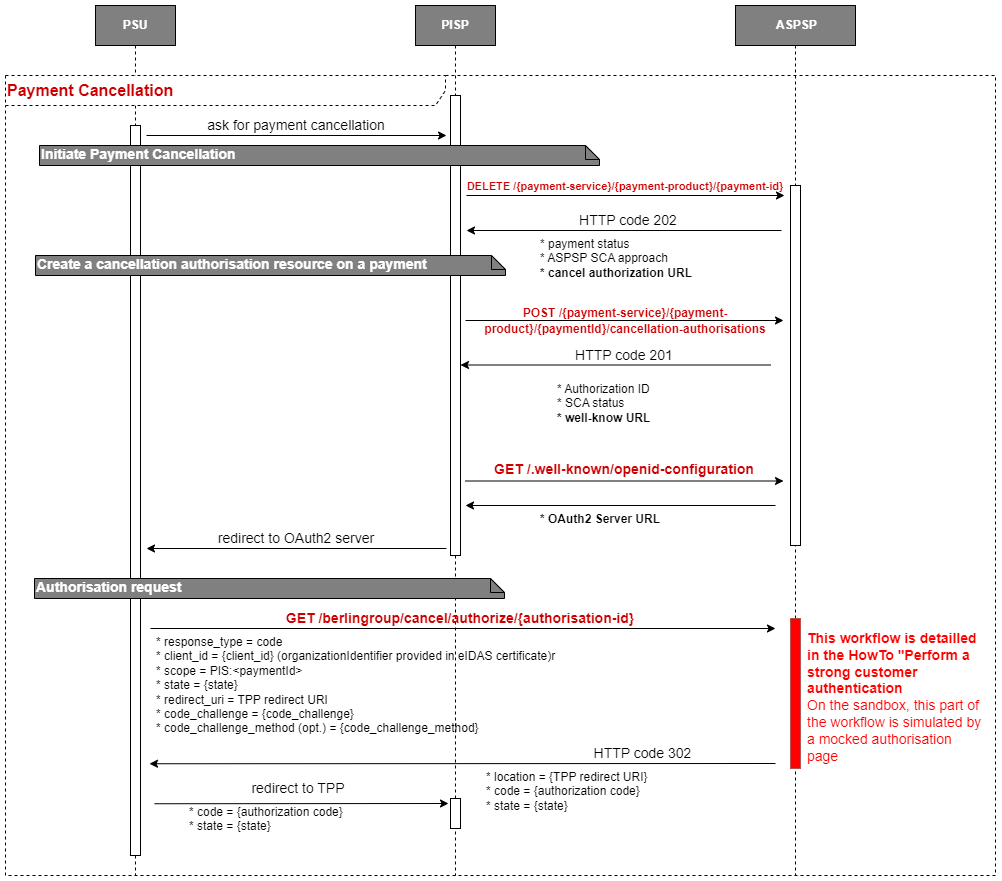

| Mandatory Authorisation on Payment Cancellation | ✖ | |

| Supported Access for MultiCurrency Accounts | ✖ | |

| Multicurrency level | Aggregation level | ✖ |

| Sub-account level | ✖ | |

| Aggregation & sub-account level | ✖ | |

| Support display of ownerNames in payment status request | ✖ | |

| Support display of psuName in payment status request and SCA status request | ✖ | |

Support of SEPA credit transfers |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✔ | ✔ | ✖ |

| Cancel | ✖ | ✔ | ✖ |

| Support of Future Dated Payments | ✔ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✖ | ✖ | ✖ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✖ | ✖ | ✖ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✖ | ✖ | ✖ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✖ | ✖ | ✖ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✔ | ✔ | ✖ |

| remittanceInformationUnstructuredArray | ✖ | ✖ | ✖ |

| remittanceInformationStructured | ✔ | ✔ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✔ | ✔ | ✖ |

| requestedExecutionTime | ✖ | ||

Support of crossborder payment |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✖ | ✖ | ✖ |

| Cancel | ✖ | ✖ | ✖ |

| Support of Future Dated Payments | ✔ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✖ | ✖ | ✖ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✖ | ✖ | ✖ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✖ | ✖ | ✖ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✖ | ✖ | ✖ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✖ | ✖ | ✖ |

| remittanceInformationUnstructuredArray | ✖ | ✖ | ✖ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✖ | ✖ | ✖ |

| requestedExecutionTime | ✖ | ||

Identification management for crossborder payment |

Supported |

||

| IBAN | ✖ | ||

| IBAN + BIC + Country Code | ✖ | ||

| IBAN + BIC | ✔ | ||

| BBAN + BIC + Country Code | ✖ | ||

| BBAN + BIC | ✖ | ||

Support of Instant SEPA credit transfers |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✖ | ✖ | ✖ |

| Cancel | ✖ | ✖ | ✖ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✖ | ✖ | ✖ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✖ | ✖ | ✖ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✖ | ✖ | ✖ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✖ | ✖ | ✖ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✖ | ✖ | ✖ |

| remittanceInformationUnstructuredArray | ✖ | ✖ | ✖ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✖ | ✖ | ✖ |

| requestedExecutionTime | ✖ | ||

Support of Target2 payment |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✖ | ✖ | ✖ |

| Cancel | ✖ | ✖ | ✖ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✖ | ✖ | ✖ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✖ | ✖ | ✖ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✖ | ✖ | ✖ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✖ | ✖ | ✖ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✖ | ✖ | ✖ |

| remittanceInformationUnstructuredArray | ✖ | ✖ | ✖ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✖ | ✖ | ✖ |

| requestedExecutionTime | ✖ | ||

| Periodic payments options | Supported | |

|---|---|---|

| Support of Day Of Execution | ✔ | |

| Supported Execution Rules | Following | ✔ |

| Preceding | ✖ | |

| Supported Frequencies | Daily | ✖ |

| Weekly | ✔ | |

| EveryTwoWeeks | ✖ | |

| Monthly | ✔ | |

| EveryTwoMonths | ✖ | |

| Quarterly | ✔ | |

| SemiAnnual | ✔ | |

| Annual | ✔ | |

| MonthlyVariable | ✖ | |